RABOBANK

- Skills: UX research, Customer journey mapping, Service Blueprint, Ideation

- Client: Rabobank

- Projects: Facturis & RisiGo insurances for business

- Tools used: Illustrator, Photoshop, Axure,

- Team: Service Design

- Tools Used: UX research, UX testing, Customer Journey mapping, Card sorting, Personas

My Role

Enable Service Design and Concept Design to optimize company insurances this bank offers together with the insurance company Interpolis. Hypothesis was that they needed a mobile app to optimize the user experience.

With the user insights, analysis to get stories, I designed a concept. With Service Design we build the customer journey to get insights where optimizations could be made in the funnel to get the customer to buy company insurances.

The Challenge – the Approach – RESULT

The Challenge

DIGITAL TRANSFORMATION

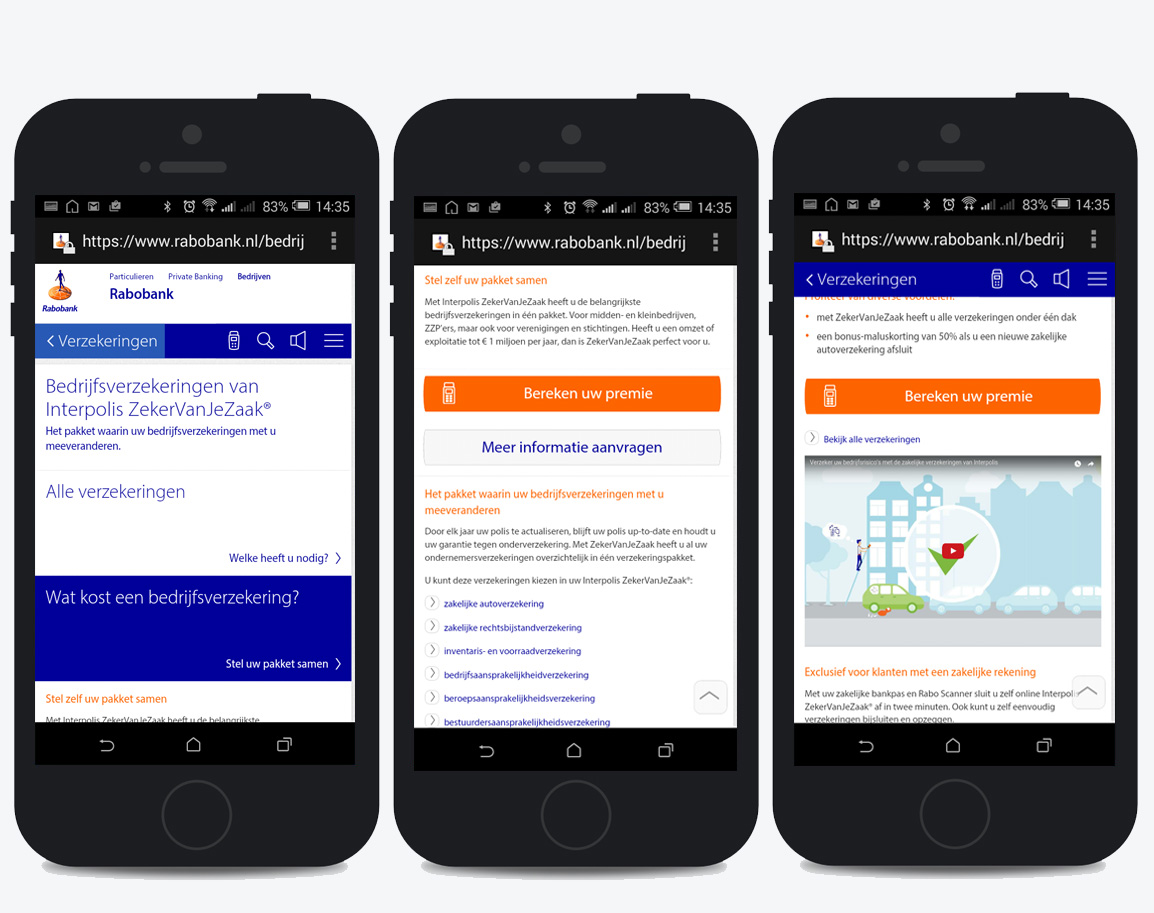

Online sales. A better user experience. The website needed to be rebuild and there should be an matching mobile application to buy insurances.

Approach

CX OPTIMAZATION

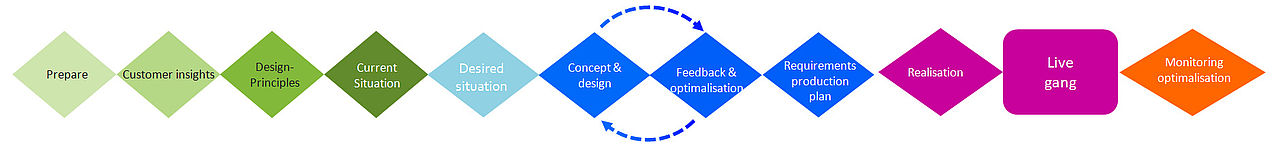

This bank conducts their own customer journey method to optimize the Customer Experience. A Customer Journey is the sequence of interactions between customers and banks in targeting, purchase, use, or closing a product or service. Customer journey’s help customer Rabobank to view themselves from a customer perspective, rather than from their own processes. A strong way to put the customer really central.

Important tool is a customer Journey map.

A Customer Journey Map is a structured and vivid visualization of the customer experience when using services of this bank. The touchpoints (of contact between the customer and the service) are placed in order and equipped with the so-called voice of the customer and the emotions of the customer so that the “journey” of the customer is clear. The result is an accessible and detailed visualization of the interaction between customer and bank and additional emotion.

CUSTOMER RESEARCH

The results of the research focuses on the needs of the customer to seal and enclose business insurance so that they can be integrated into the development of a mobile version of the website Zeker van je Zaak.

For this purpose I did 7 interviews with 7 owners of the businesses.

SCOPING

After the interviews the insights are visualized. Next you see a visualization of the relationship between the various journeys in the Customer Life Cycle: From awareness until terminating the service. In this FISHBONE you get an overview of which Customer Journeys can be reviewed and altered.

CUSTOMER JOURNEY MAP

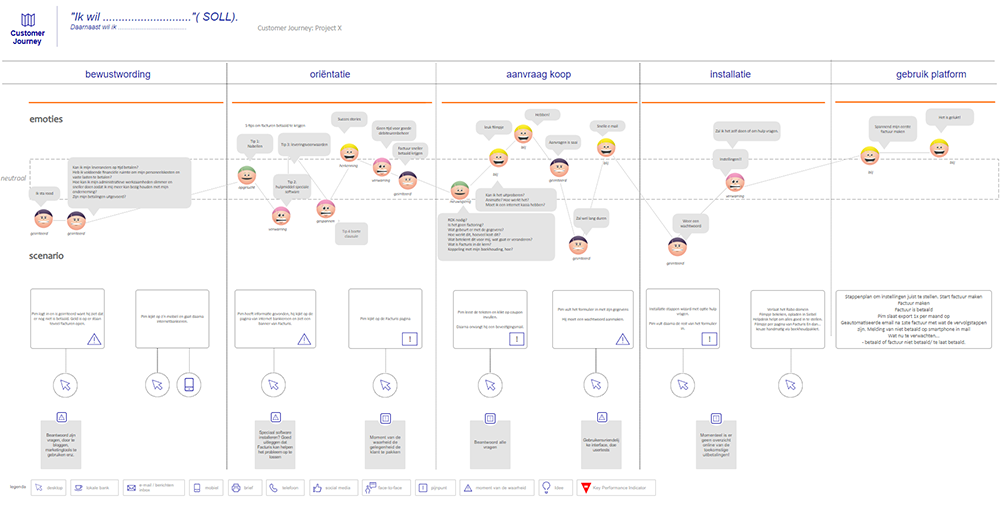

The Customer Journey Map has some solid components, also known as the swimming lanes. From the top down.

Swimming lanes

Emotions: Customer emotion at every step in the journey.

Narrative: What does the customer? These are the actual steps of the customer journey.

Touchpoints: How has the customer interacts with the bank or other actor in the customer journey. Below the map is a list of touchpoints we distinguish.

Channels

Ideas

RESULT

TESTING WITH PROTOTYPE

In co creation with a UX Designer from the IT development the research and workshops insights were translated into this prototype.

In this UXlab we tested the prototype with a few customers who were willing voluntarly to test the app. These pictures above show the lab where we did the testing. The people you see are modeling how this UXlab can be used.

FACTURIS

Rabobank SME customers can receive trial credit on the basis of business invoices sent. Rabobank is starting a pilot for this with its FinTech joint venture Facturis. With the Invoice credit, customers can dispose of their money before their customers pay and are often cheaper than with a standard bank overdraft.

For this product I facilitated a few workshops to propose a redesign. Instead of making an invoice by hand this application should integrate in the system you already have running at your business. It makes an e-invoice. For this product we did the research and came with quite a lot of conclusions. I visualized all the insights in three different maps.

Invoice credit is a customized credit, it moves with the invoice flow of the entrepreneur. The entrepreneur only pays for the credit that Rabobank actually provides. It is an alternative to standard current account credit, where there is a fixed maximum credit limit, for which the customer pays a fixed price. With the Invoice credit, the customer only pays for the use and the variable credit maximum.

The flexibility of the invoice credit makes it easier for SME entrepreneurs to streamline the cash flows of purchases and sales and thus optimize their working capital. Invoice credit meets the need of SME entrepreneurs for a credit that responds to fluctuations in the invoice flow and that grows with the development of the company.

Facturis offers a platform with which SME entrepreneurs send their business invoices digitally. Rabobank adjusts the amount of the invoice credit on a weekly basis on the basis of these invoices sent, less the invoices already paid. In addition, based on the services provided by Facturis related to the Invoice credit, the customer receives real-time insight into the invoices sent, paid and outstanding.

The trial will run until the end of June 2017 and will take place with a limited group of SME customers from six local Rabobanks: Amstel and Vecht, Amsterdam, The Hague Region, Eindhoven-Veldhoven, Het Haringvliet and Hart van Brabant.